1 Which of the Following Best Describes Automatic Stabilizers

B The amount of tax revenues collected rises when an economy is booming. An example of an automatic stabilizer is.

Solved Which Of The Following Best Describes Automatic Chegg Com

What are automatic stabilizers.

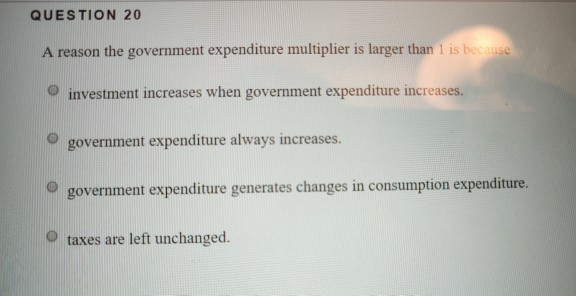

. 1 The size of the balanced-budget multiplier varies inversely with the level of GDP. The best-known automatic stabilizers are corporate and personal taxes and transfer systems such as unemployment insurance and welfare. Automatic stabilizers are mechanisms built into government budgets without any vote from legislators that increase spending or decrease taxes when the economy.

The analysis found for example that stabilizers increased the deficit by 329 in fiscal 2009 as the deficit soared to 14 trillion as a result of the Great Recession and by 476 in fiscal 2010. Fiscal policy refers to. An advantage of automatic stabilizers over discretionary fiscal policy is that 1.

Which of the following best describes a countrys external debt. Offset the destabilizing influence of changes in tax revenuesB. Aggregate demand in the economy will be less than it would be without automatic stabilizers.

An automatic fiscal policy stabilizer is a type of fiscal policy that is intended to counteract economic fluctuations by stabilizing the economy through its normal economic functioning. Automatic stabilizers are so called because they act to stabilize economic cycles and are automatically triggered without. Analysis conducted by the Congressional Budget Office in 2013 estimated the effects of automatic stabilizers on budget deficits and surpluses in each fiscal year since 1960.

1 peso 1400 yen e. Best known automatic stabilizer are corporate and personal taxes and transfer systems unemployment insurance and welfare Automatic stabilizers are so called because. Government policies and institutions can act as automatic stabilizers.

Spending on these programs increase during recessions and decrease during expansions. In a recession because of the decline in economic output less income is earned and so less in taxes is automatically collected. An automatic fiscal policy stabilizer is a type of fiscal policy that is intended to counteract economic fluctuations by stabilizing the economy through its normal economic functioning.

Automatic stabilizers are a type of fiscal policy that happen automatically and tend to offset fluctuations in economic activity without direct intervention from policymakers. 1 peso 050 d. 1 yen 14 pesos c.

An automatic stabilizer does not require specific government authorization or decision of policymakers. Business Economics QA Library Which of the following best describes the built-in stabilizers as they function in the United States. Manipulation of government purchases and taxes for the purpose of stabilizing real output employment and the price level.

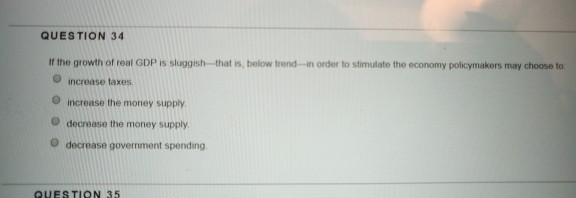

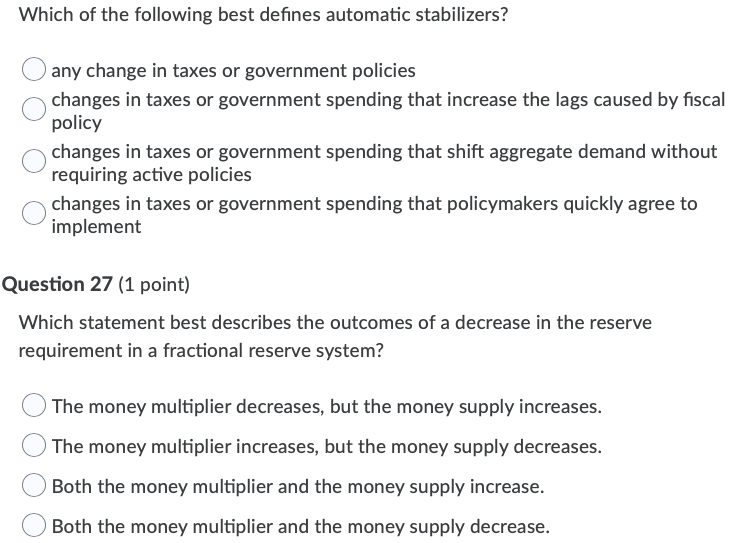

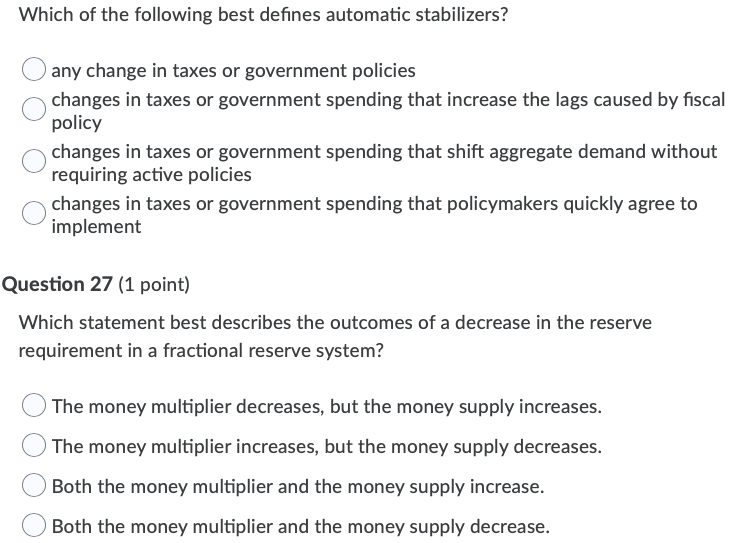

Changes in taxes and government purchases made by legislation for the purpose of stabilizing the economy. Any change in taxes or government policies changes in taxes or government spending that increase the lags caused by fiscal policy changes in taxes or government spending that shift aggregate demand without requiring active policies changes in taxes or government spending that policymakers quickly. Automatic stabilizers can do which of the followingA.

Many countries have government agencies that help out when people are out of work such as welfare payments or unemployment compensation. Aggregate demand in the economy will be the same as it was before the recession. The best example of automatic stabilizers are.

Automatic stabilizers can be easily fine-tuned to move the economy to full employment. Fiscal policy refers to the. 1 Which of the following best describes the effect of automatic stabilizers during a period of recession in an economy.

1 yen 280 pesos b. Automatic stabilizers are created with the goal to stabilize income levels consumption patterns or demand business spending and get automatically triggered-without specific authorization. Allow policymakers to formulate a set of rules flexible and comprehensive enough to eliminate discretionary actionsD.

Automatic Stabilizers Exercise 1 A key feature of all automatic stabilizers is that they. Which of the following best defines automatic stabilizers. The term automatic stabilizer refers to a fiscal policy formulation that is designed as an immediate response to fluctuations in the economic activity of a country.

We can conclude that. Cost-of-living escalators in government contracts and pensions. Progressively increasing corporate income taxes.

A It is the portion of the total national debt that is. Automatic stabilizers take effect very quickly whereas discretionary policy can take a long time to implement. 2 on a question.

Which of the following is an example of an automatic stabilizer. Automatic stabilizers are so called because they act to stabilize economic cycles and are automatically triggered without explicit government action. A personal and corporate.

Expansionary Fiscal Policy - Graphically Exercise 4 The graph below depicts an economy where a decline in aggregate demand has caused a recession. It falls below because less tax revenue than expected is collected. Automatic stabilizers are not subject to the same time lags as discretionary fiscal policy.

A Spending on unemployment benefits falls when the economy enters a recession. 1 peso 14 QA Which of the following statements best describes automatic stabilizers as they function in Canada. Automatic stabilizers are tax and spending programs that counteract the business cycle by increasing aggregate demand during recessions and decreasing aggregate demand during expansions without intervention by the government or policy makers.

2 Personal and corporate income tax collections automatically fall and transfers and subsidies automatically rise as GDP rises. Free university tuition for unemployed workers after six months of unemployment provided that they are under 30 years old and have had five or more years of full-time work experience since high school. The best-known automatic stabilizers are corporate and personal taxes and transfer systems such as unemployment insurance and welfare.

Which of the following would be automatic stabilizers. Aid the economy to move away from the full-employment output levelC. Are aimed at expanding the economy.

Cause tax revenues to decrease.

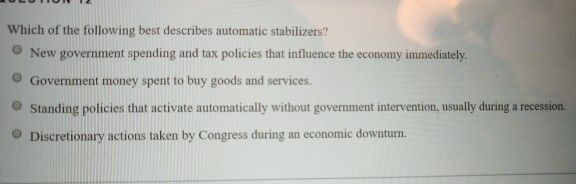

Solved Which Of The Following Best Describes Automatic Chegg Com

Solved Which Of The Following Best Defines Automatic Chegg Com

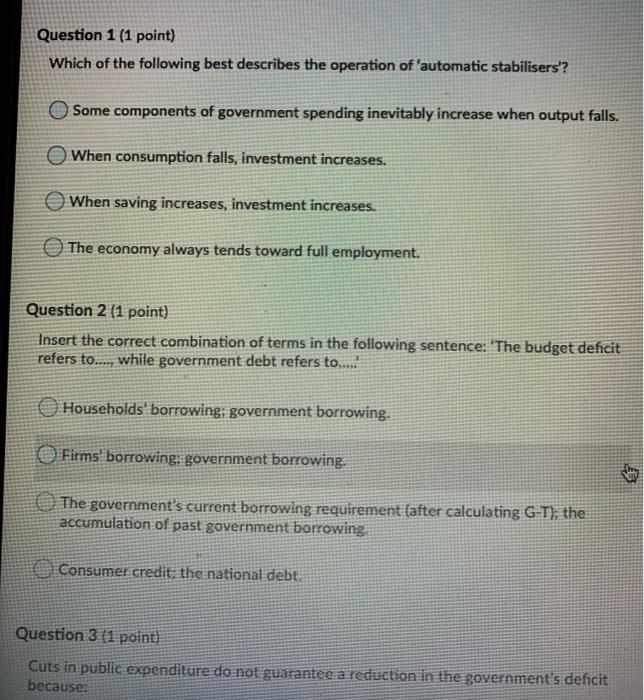

Solved Question 1 1 Point Which Of The Following Best Chegg Com

Solved Which Of The Following Best Describes Automatic Chegg Com

Comments

Post a Comment